Self-Employed Tax Return

Maximum Refund & Tax Savings Guarantee

Our self-employed tax preparation services are tailored to meet the unique needs of freelancers, contractors, and small business owners. We ensure your tax return is prepared and filed accurately, maximizing your refund and optimizing tax savings while adhering to all applicable tax laws and regulations.

Our Services Include

Comprehensive Tax Preparation and Filing

- We meticulously prepare and file your tax return, taking into account the complexities associated with self-employment.

- Our expertise guarantees compliance with federal, state, and local tax laws, minimizing the risk of errors and penalties.

Business Expense Optimization

- We help you identify and categorize business expenses to maximize your tax benefits.

- Our services include guidance on home office deductions, vehicle expenses, and other business-related costs.

Maximum Refund & Tax Savings Guarantee

- We analyze your business expenses, income, and deductions to ensure you receive the maximum refund and tax savings.

- Our in-depth knowledge of self-employment tax regulations allows us to identify all eligible deductions and credits.

IRS Audit Representation and Resolution

- In the event of an IRS audit, we provide expert representation to ensure a smooth and stress-free process.

- We handle all communications with the IRS on your behalf, working diligently to resolve any issues that arise.

Why Choose Us?

- Expert Knowledge: Our team consists of experienced professionals who stay updated with the latest tax laws and regulations.

- Personalized Service: We tailor our services to meet your specific needs, ensuring you get the most out of your tax return.

- Peace of Mind: With our IRS audit representation, you can rest assured that you are in good hands should any issues arise.

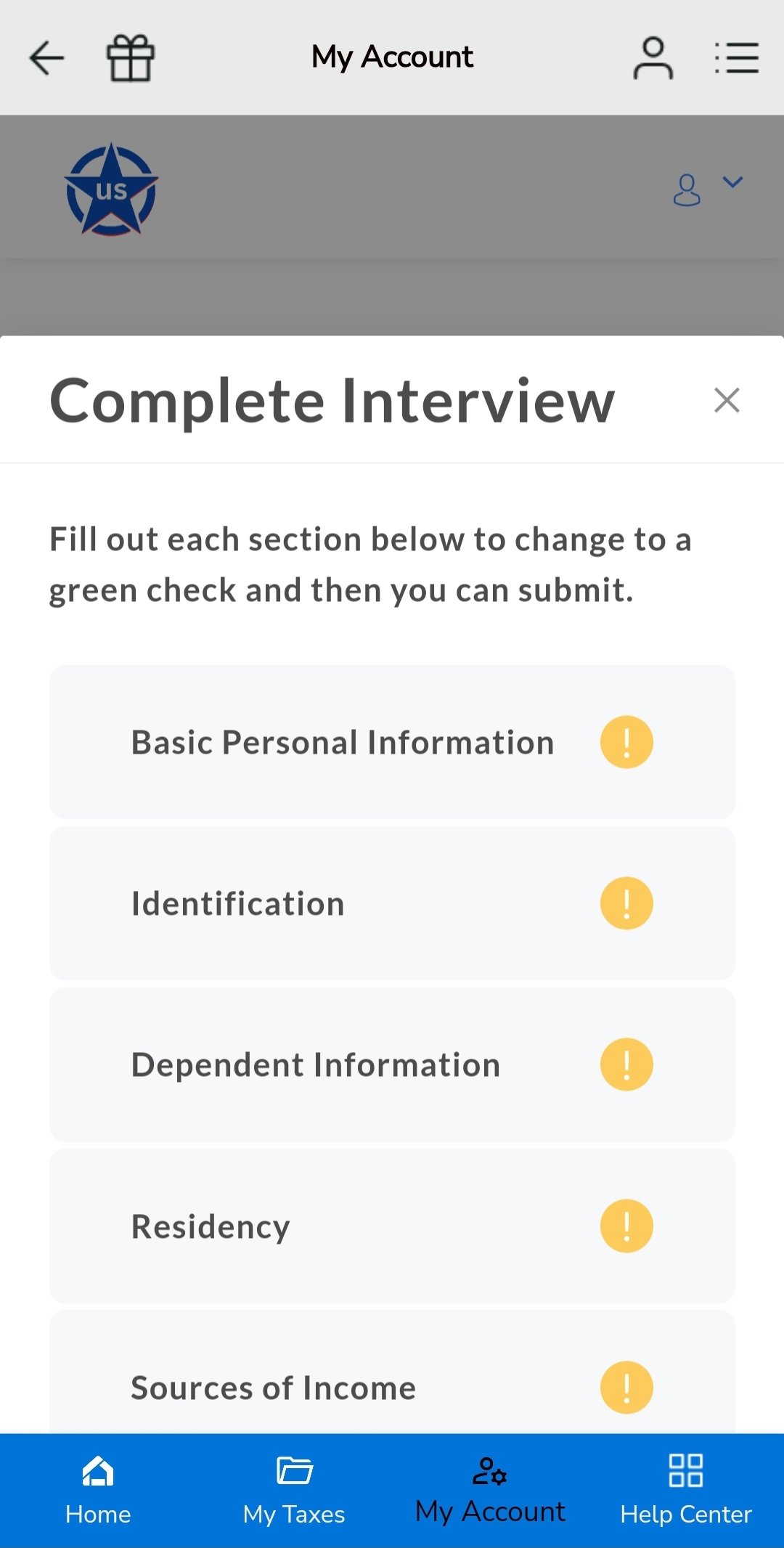

How We Work

- We begin with a thorough consultation to understand your financial situation and tax-related needs.

- Our team provides tailored advice on tax planning strategies to minimize liabilities and enhance savings.

- Using advanced tax software and tools, we prepare your tax return with precision and accuracy.

- We review your financial documents to ensure all eligible deductions and credits are applied.

Filing & Support

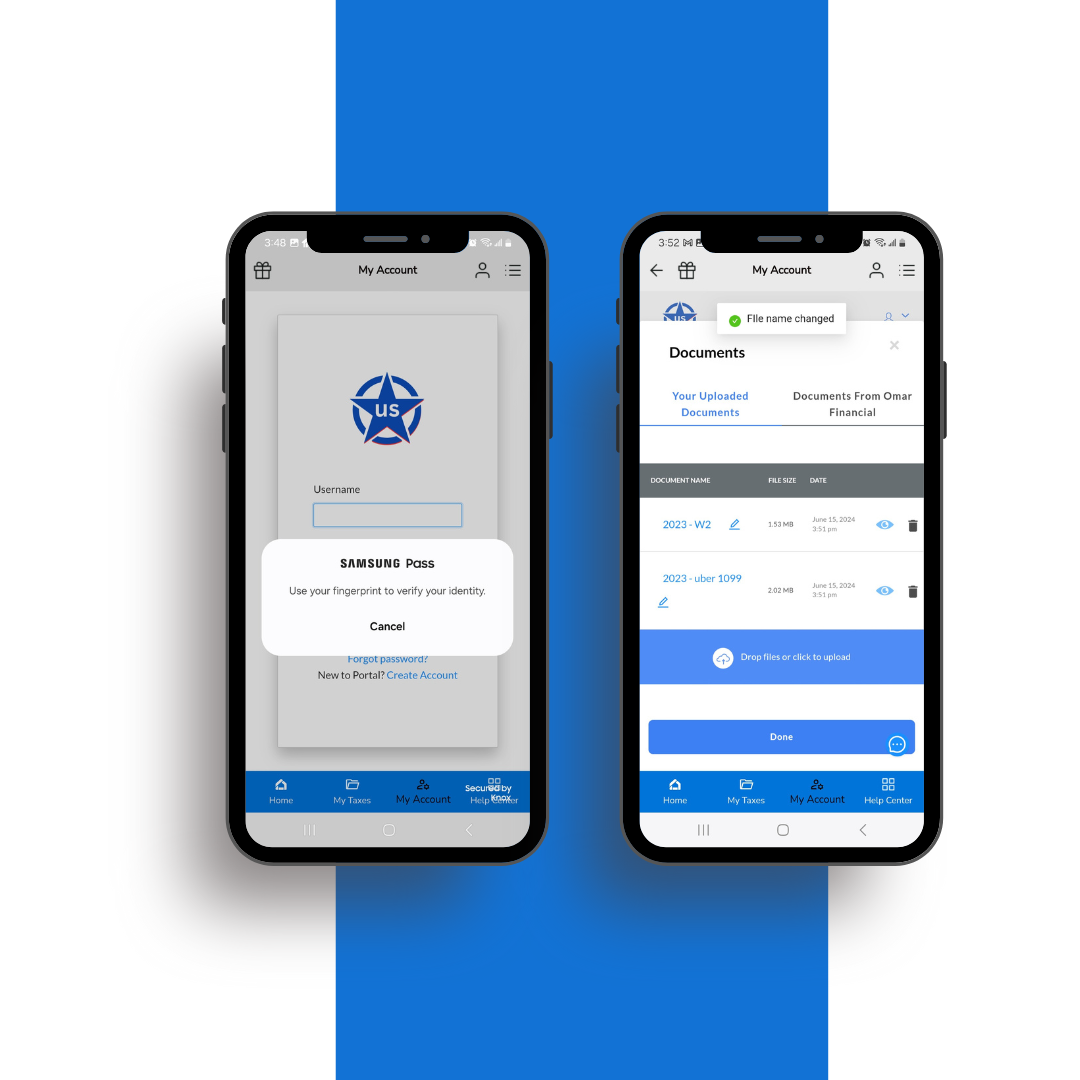

- We file your tax return electronically, ensuring timely submission and prompt processing.

- You receive confirmation of your filing along with detailed records of your tax return.

- Should you need any assistance or face an IRS audit, our team is ready to represent and support you.

- We handle all communications and work towards a favorable resolution on your behalf.

Download TaxApp

Choose our individual tax preparation services for a hassle-free, accurate, and maximized tax return experience. We are committed to delivering the highest level of service and ensuring you get the most out of your tax return.

For more information or to schedule a consultation, please contact us at [Contact Information]. Let us help you achieve the maximum refund and tax savings you deserve!